92% of Malaysians Over 40 Have No Plan for Long-Term Eldercare - Until It’s Too Late

Stop relying on medical insurance that only covers hospital bills.

Discover the overlooked eldercare plan that covers long-term care, private nurses, and retirement homes.

2-Hour Live Zoom · One Night Only · No Replays

Date

(Tue) 30 Dec 2025

Time

8PM - 10PM

Date

Zoom

The 3 Biggest Concerns Stopping Most Malaysians from Planning Eldercare

“I already have medical insurance, isn’t that enough?”

Most policies only cover hospital bills, not long-term care, private nurses, or retirement homes.

“I’m still healthy, isn’t it too early to plan?”

That’s actually the best time. You qualify for better plans and lower rates before any health issues appear.

“I’m not rich, can I even afford this kind of care?”

That’s the beauty of this strategy. It’s designed to make premium care accessible, without draining your savings or EPF.

It’s normal to feel this way.

That’s exactly why we built this webinar, to help you overcome these doubts and finally move forward with confidence.

2-Hour Live Zoom · One Night Only · No Replays

Tony Robbins often stresses: “You must have Long-Term Care protection...”

According To The New York Times:

70% of people over age 65 will need some form of long-term care, such as nursing support, rehabilitation, help with bathing, feeding, or dementia care, yet only 20% have long-term care insurance.

The Harsh Truth About Aging That No One Talks About

70% of people over age 65 will need some form of long-term care, things like nursing support, rehab, help with bathing, feeding, or dementia care.

But here’s the scary part:

Only 20% have long-term care insurance.

That means 80% end up paying out of pocket… or becoming a financial and emotional burden on their children.

The Cost is Crushing

In Malaysia, your hospital medical card ≠ long-term care coverage.

It won’t pay for nursing homes, in-home caregivers, or rehab.

Here in Malaysia, care costs average RM7,000/month - that’s RM420,000 in just 5 years.

With inflation, the next 10 years could easily push this to RM1 million.

And the leading causes?...

38% - Stroke

26% - Cancer

6% - Degenerative diseases

(Aviva 2018–2020 claims data)

Even more shocking:

1 in 3 people will be severely disabled for over 10 years.

The average care period is 4 years - and it’s not “just a few months.”

When Should You Plan for Long-Term Care?

Not when you’re old. Now.

Because once you lose mobility, from a stroke, accident, or illness, it’s too late to qualify for the best options.

Long-term care means needing daily help for basic activities like:

✿ Bathing

✿ Continence

✿ Mobility

✿ Dressing

✿ Eating

✿ Transfer

The Real Problem... Long-term care = long-term expenses.

Without a plan, you’ll either drain your savings or rely on family, and neither is a dignified way to live.

The good news?

In just 2 hours webinar, you’ll discover a plan to get quality care without using your savings, keep your freedom, and make sure your family never has to carry the burden.

2-Hour Live Zoom · One Night Only · No Replays

my clients' stories

A 69-year-old former headmistress in Bukit Mertajam suffered a stroke, but her elder care insurance paid RM 355,041.96, covering her care and easing her family’s burden. Nearing 79, she’s grateful for planning ahead - proof that elder care insurance helps anyone age with dignity and peace of mind.

At 58, a single multinational company director secured disability coverage to ensure quality long-term care if needed. 4 years later, she suffered a severe stroke at work, and the long recovery meant she could not return to her job. Her policy paid RM 300,000, providing vital financial support.

The Big Misunderstanding: Thinking Your Medical Card Covers Eldercare

Over the 15+ years working with retirees and families, I’ve seen this myth leave many people shocked and unprepared.

Medical cards cover hospital bills - not ongoing care from a nurse, caregiver, or assisted living.

See the chart below for a clear breakdown.

Medical card

What it covers?

Hospital bills, surgery, medicationWhen it pays?

While you’re in the hospitalAfter hospital

Stops paying after dischargeAverage duration of claim

Days to weeksMain purpose

Protect you from high hospital bills

Eldercare Insurance

What it covers?

Long-term care: private nurse, in-home caregiver, rehabilitation.When it pays?

When you lose independence (can’t perform 3 out of 6 activities of daily living like Bathing, Continence, Mobility, Dressing, Eating and Transfer)After hospital

Continues paying for months or years if neededAverage duration of claim

Years (average 4 years, some over 10 years)Main purpose

Protect your lifestyle, savings, and family from long-term care costs

2-Hour Live Zoom · One Night Only · No Replays

My client’s top reason for eldercare planning.

01

“I Have Financial Support When I Need It Most”

If I ever need long-term care, whether it’s a private nurse, a retirement home, or changes to my house, I won’t have to drain my savings or sell my assets to pay for it. My plan takes care of the cost.

02

“I Keep My Dignity and Independence”

I get to decide where I live, who looks after me, and how I want to spend my later years. I’m not forced into choices I don’t want just because of money.

03

“I Won’t Be a Burden on My Children

My kids can focus on being my family, not my full-time caregivers. They don’t have to give up their jobs or struggle financially to look after me.

04

“I Have Peace of Mind...”

I can enjoy my life today without worrying about the “what ifs.” My family and I kn ow I’m protected, no matter what happens.

You Have 2 Choices:

Keep doing it the old way

Put off planning - until it’s too late and your options are gone.

Rely on your children, even if they’re already stretched.

Risk losing your freedom - and ending up in a place you didn’t choose.

Or switch to the new way

Follow V100 Consultantcy Eldercare Financial Blueprint and plan with confidence.

Enjoy peace of mind, knowing you’ll never be a burden.

Retire with dignity, independence, and choice.

What You’ll Learn in This 2 hours Eldercare Financial Blueprint webinar:

In just 2 hours, you’ll walk away with a full roadmap to protect your future:

How to take full control of your aging journey

Never leave your future to luck, your children, or the government.

How to secure a luxury lifestyle, private care, or retirement resort

WITHOUT draining your savings or EPF.

How to multiply your capital 10X

By using financial strategies designed specifically to fund eldercare while preserving your wealth and legacy.

How to plan even if you’re single, divorced, or have no children

So you’re never left without support, care, or choices.

2-Hour Live Zoom · One Night Only · No Replays

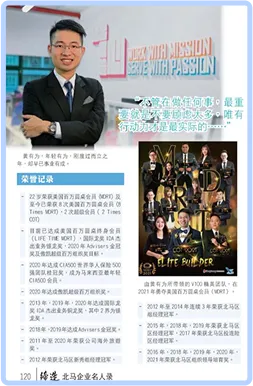

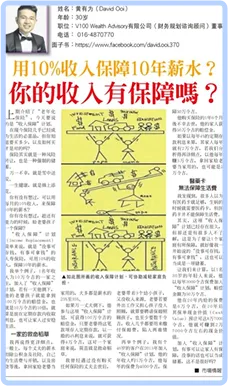

Meet Your Trainer: David Ooi

David Ooi

Founder of V100 consultancy

David Ooi is Malaysia’s first and only eldercare financial planning specialist.

Starting in the insurance industry at just 21, he achieved President Club Award by 24, led mega million dollar agencies, and broke national records.

With 36+ major awards and 14-time Million Dollar Round Table recognition, David has helped countless families secure their future - ensuring they never burden loved ones or sacrifice quality of care.

In this 2-hour webinar, he shares the proven eldercare financial blueprint that lets you retire with dignity, stay independent, and have complete financial control.

If you want to prepare wisely and early, this webinar is for you.

🏆 Achievements & Recognition

President Club Manager (FY 2020/2021)

4× Champion Agency Manager

(Northern Region)3× Champion Unit Manager

(Northern Region)

National Advisor Award

6× COT | 8× MDRT Qualifier

4x Akard Award Mega Million Dollar Agency

CIA500 世界华人保险500强团队 (2023, 2022, 2021)

💼 Experience

15 Years of Professional Excellence in the insurance industry

💼 Experience

15 Years of Professional Excellence in the insurance industry

Frequently Asked Questions

Do I need to pay for this seminar?

No. It’s completely FREE. But seats are limited.

I already have medical insurance. Why attend?

Because most medical plans only cover hospital bills — not caregiving, private nurses, or retirement lifestyle.

What if I’m not sure I qualify?

That’s what the webinar is for. We’ll show different plans that match your health and life stage.

What if I have other commitments that day?

This is a rare, live-only event with no replay. Prioritize your future.

Date

(Tue) 30 Dec 2025

Time

8PM - 10PM

Date

Zoom

It’s Never Too Late

But Don’t Wait Until It Is...

The best time to start eldercare planning was years ago.

The second-best time is today.

In this 2-hour webinar, he shares the proven eldercare financial blueprint that lets you retire with dignity, stay independent, and have complete financial control.

If you want to prepare wisely and early, this webinar is for you.

2-Hour Live Zoom · One Night Only · No Replays

Designed by Convert Mission Media

© Copyright. V100 Consultancy Group

Terms & Conditions | Privacy Policy